Debt Buying Real Estate in Upstate New York: Opportunities and Considerations

Debt investing in property has gained traction as a tactical, usually much less volatile option in real estate financial investment. For financiers considering Upstate New York, financial debt investing uses a special means to go into the property market without the functional obligations related to straight residential property possession. This overview checks out financial obligation investing in Upstate New York, outlining crucial techniques, advantages, and factors to consider for taking full advantage of returns in this area's broadening real estate market.

What is Financial Debt Buying Property?

In property financial debt investing, capitalists supply finances to realty programmers or property owners instead of acquiring the residential properties themselves. This investment version permits financiers to make interest earnings, with the home as security in case of default. Financial obligation investing can be structured with different kinds, such as:

Direct Car loans - Capitalists financing funds directly to residential or commercial property programmers or property managers.

Realty Investment Company (REITs) - Some REITs focus only on financial obligation investments, pooling funding to buy mortgages and debt-related items.

Real Estate Crowdfunding - Online systems that permit investors to add smaller sized quantities toward a larger finance, providing access to a varied real estate debt portfolio.

Why Pick Upstate New York for Debt Property Spending?

Upstate New York presents several benefits for real estate financial debt capitalists, driven by its mix of city revitalization and suv demand. Trick factors that make this region appealing for financial obligation capitalists include:

Growing Realty Market

Cities like Buffalo, Rochester, Syracuse, and Saratoga Springs have actually seen development in real estate demand. The enhanced rate of interest in both household and business real estate, typically driven by a change towards suv and small-city living, develops chances for consistent financial debt financial investments.

Diverse Residential Property Kinds

Upstate New york city supplies a selection of property kinds, from household homes to multi-family properties and commercial buildings. The diversity allows financiers to select buildings with differing threat degrees, lining up with various financial investment objectives and timelines.

Secure Need with Less Volatility

Compared to New York City City, the Upstate market has a tendency to be much more steady and less affected by quick rate variations. This security makes financial obligation investments in Upstate New York a strong alternative for financiers seeking lower-risk returns.

Budget-friendly Entrance Factors

Building worths in Upstate New York are generally less than those in the city, enabling investors to participate in the property financial obligation market with fairly smaller capital outlays, making it excellent for both novice and seasoned financiers.

Benefits of Financial Debt Purchasing Upstate New York Property

Passive Revenue Generation

Financial debt investing in real estate can be an ideal means to generate regular passive revenue without the hands-on monitoring needed in straight residential property ownership. Capitalists get normal rate of interest settlements, supplying foreseeable earnings streams.

Collateralized Security

In a financial obligation financial investment, the residential property serves as security. In case of a default, financial debt investors might have the possibility to confiscate on the residential property, including an additional layer of safety to their financial investments.

Shorter Financial Investment Horizons

Contrasted to equity investments in property, debt investments usually have shorter timeframes, commonly ranging from one https://sites.google.com/view/real-estate-develop-investment/ to 5 years. This flexibility attract financiers looking for returns in a shorter period while preserving an option to reinvest or exit.

Possibly Lower Threat

Financial debt capitalists generally rest higher on the capital stack than equity financiers, suggesting they are settled first if the customer defaults. This decreased danger profile, integrated with normal earnings, makes financial debt investing attractive to risk-averse financiers.

Trick Approaches for Effective Financial Obligation Buying Upstate New York

Examine Building Place and Market Trends

Analyzing home areas within Upstate New york city's varied landscape is essential. Debt financial investments in high-demand locations, such as household areas near significant employers or expanding commercial centers, are generally more secure bets with a reduced threat of consumer default.

Companion with Reliable Debtors

Vetting customers is important in debt investing. Look for consumers with a solid track record in realty advancement or property administration in Upstate New york city. Experienced customers with proven tasks lower default danger and contribute to steady returns.

Pick a Mix of Residential and Commercial Financial Obligation

To branch out threat, take into consideration financial obligation investments in both property and commercial buildings. The property industry in Upstate New york city is reinforced by steady real estate demand, while business residential properties in rejuvenated metropolitan locations use chances for greater returns.

Leverage Property Financial Obligation Operatings Systems

Platforms like PeerStreet and Fundrise permit capitalists to participate in realty financial obligation with smaller payments. Some platforms concentrate specifically on Upstate New york city properties, enabling a local investment strategy. These platforms simplify the procedure of identifying financial obligation possibilities with pre-vetted customers, due diligence, and paperwork.

Potential Obstacles in the red Investing in Upstate New York

Danger of Default

As with any kind of finance, financial obligation investing carries a threat of customer default. Very carefully analyzing the borrower's credit reliability, the residential or commercial property's location, and the car loan terms can assist minimize this threat.

Liquidity Constraints

Real estate financial obligation financial investments commonly secure capital for a fixed duration. Unlike stocks or bonds, debt financial investments can not constantly be swiftly sold off. Investors need to be gotten ready for these funds to be unavailable until the finance term finishes or a second market sale ends up being practical.

Rates Of Interest Level Of Sensitivity

Property financial debt returns are influenced by dominating rates of interest. Climbing rates of interest can influence consumers' capacity to settle, specifically if they rely upon variable price lendings. Analyzing just how possible price adjustments may impact a particular investment is important.

Due Persistance Demands

Real estate debt investing calls for thorough due persistance to determine practical opportunities. Investors need to take a look at home values, rental need, and debtor credentials to minimize threat and make sure that the investment straightens with individual financial objectives.

Exactly How to Get Started with Financial Debt Property Buying Upstate New York

Research Market Trends

Begin by checking out realty patterns in Upstate New york city's noticeable cities and communities, including Buffalo, Rochester, and Albany. Understanding local market patterns aids in determining possible growth locations and emerging financial investment chances.

Connect with Neighborhood Real Estate Investment Groups

Real estate investment groups and clubs in Upstate New York can be useful resources for networking, market understandings, and recommendations on reputable financial debt financial investment options. These groups often supply access to special bargains and information on high-potential jobs.

Take Into Consideration REITs with Regional Focus

Some REITs and realty funds focus especially on financial debt investments in Upstate New york city. These vehicles enable investors to take advantage of financial debt financial investments while acquiring geographical diversity and professional management.

Deal With Property Financial Investment Advisors

For personalized assistance, take into consideration collaborating with a financial consultant or financial investment specialist that specializes in property. An expert with regional knowledge can help recognize quality financial debt investment chances that align with your danger tolerance and economic objectives.

Last Ideas on Debt Buying Upstate New York Property

Financial obligation investing in property supplies a special mix of protection and revenue generation, making it a wonderful choice for those wanting to diversify their financial investment profiles. Upstate New York, with its steady demand, varied residential or commercial property choices, and revitalized cities, provides an ideal backdrop for financial debt financial investments that can yield constant returns.

By concentrating on due diligence, recognizing regional market patterns, and selecting reliable consumers, financiers can make enlightened choices that maximize their returns in this area's prospering real estate market. For capitalists seeking a relatively low-risk means to take part in Upstate New York's development without directly managing homes, financial obligation investing is an outstanding course ahead.

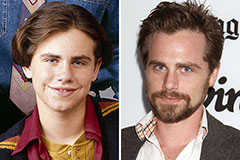

Rider Strong Then & Now!

Rider Strong Then & Now! Shane West Then & Now!

Shane West Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!